Customer satisfaction is paramount in any industry to ensure returning custom, but with customer drop off so high in the insurance industry, it is even more important.

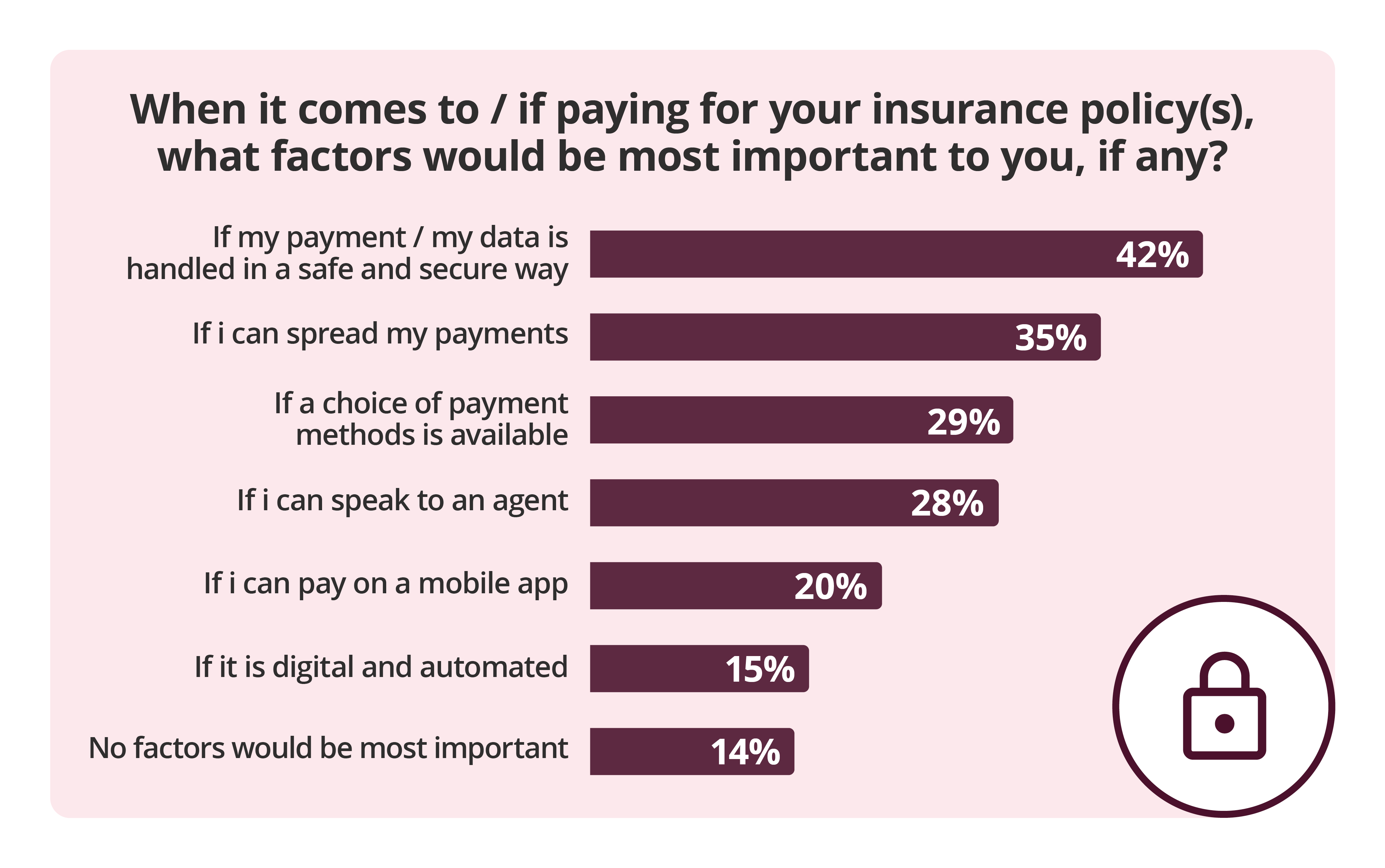

As mid-market insurance businesses aim to offer seamless services throughout the policy process, addressing payment friction at the start of the customer journey becomes a crucial priority. A smooth payment experience not only boosts customer satisfaction but also plays a significant role in fostering customer retention and overall business success.

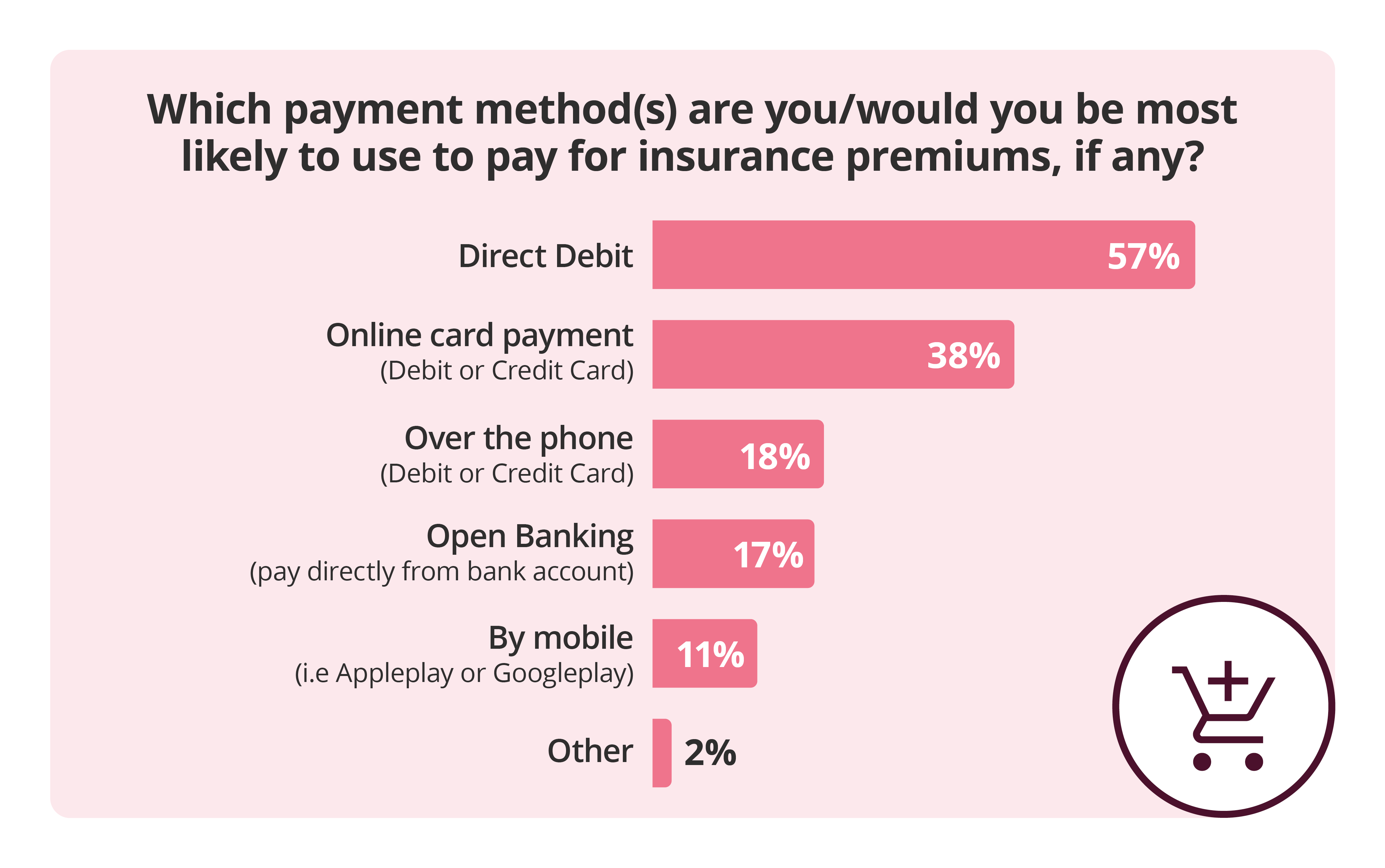

In today's fast-paced world, policyholders of all kinds have come to expect convenience at every step, including the payment process. When prospective policyholders encounter obstacles or friction during payments; from issues with data security to customers not being able to pay with their preferred payment method, it can lead to frustration, pose risks to customer acquisition and customer loyalty.

Specifically tailored for insurance companies and brokers of all sizes, this guide delves into the ever-evolving landscape of consumer trends and behaviors within the insurance sector.

Selecting the ideal payment provider for your mid-market insurance company is crucial in addressing the above challenges. By teaming up with a specialised payment provider, insurers can expand their customer base, future-proof their business, and cultivate positive payment experiences for all upcoming clients.

But how can mid-market insurers be confident that they are partnering with the ideal payment provider for their specific requirements?

In a competitive insurance landscape, providing a frictionless payment experience is a strategic advantage. By partnering with a specialised payment provider, mid-market insurance companies can not only address the challenges of payment friction but also create a positive impression on potential policyholders. Prioritising a seamless payment process contributes to increased customer satisfaction, loyalty, and ultimately, business success.

If you're ready to elevate your payment experience and boost customer satisfaction, Access PaySuite is here to help. Contact us today to explore tailored solutions for your insurance business.

In this article, we will explore how insurance payment solutions can be the differentiating factor between firms and delve into five key strategies that can help insurers harness the true potential of these solutions to drive value and achieve sustainable growth.

Read more

Insurance companies spend a lot of their time thinking about demographics, particularly life insurers, but this is often purely from a risk point of view, but now more than ever firms need to think about the changing faces of their customers, otherwise they could find themselves behind the curve.

Read more

What is the most important reason or benefit for your customers to sign up? The advantages of Direct Debit are numerous. You can choose specific messaging to communicate with your target audience. For example, you may want to convey that Direct Debit is convenient, easy and hassle free.

Read more