In the age of digital innovation, Generation Z are emerging as trailblazers, and as such, are redefining industries. We explore the evolving realm of insurance, fueled by the younger generations evolving payment preferences.

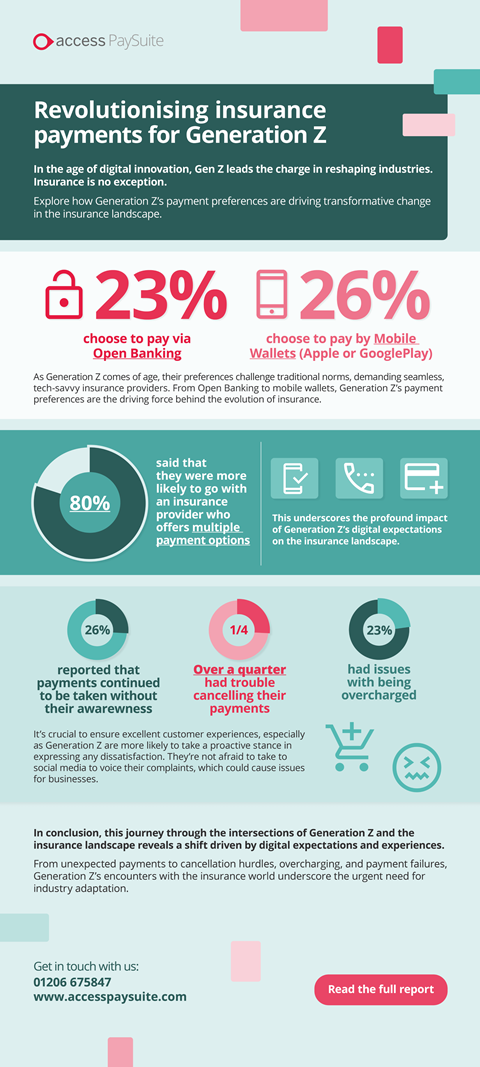

As this generation comes of age, their preferences are challenging traditional norms, demanding a seamless and tech-savvy approach to insurance transactions. From Open Banking to mobile wallets, the forces propelling the evolution of insurance are going to be based around Generation Z's payment preferences.

Gen Z report being victims of unauthorised payments, challenges in cancelling payments, reported instances of being overcharged, and payment failures. But what sets Generation Z apart is their proactive approach in voicing discontent – an inclination evident through their propensity to leverage social media and the internet to register complaints, which can be catastrophic for any small or medium insurance business.

The challenges faced by Generation Z in navigating the realms insurance payments are becoming increasingly evident. Our infographic sheds light on these hurdles, highlighting the need for adaptation and innovation in the industry.

To better understand and effectively cater to the evolving preferences of this demographic, we invite you to read the full report, which delves deeper into actionable strategies to meet the demands of Generation Z in the ever-changing landscape.

If you're ready to elevate your payment experience and boost customer satisfaction, Access PaySuite is here to help. Contact us today to explore tailored solutions for your insurance business.

In this article, we will explore how insurance payment solutions can be the differentiating factor between firms and delve into five key strategies that can help insurers harness the true potential of these solutions to drive value and achieve sustainable growth.

Read more

Insurance companies spend a lot of their time thinking about demographics, particularly life insurers, but this is often purely from a risk point of view, but now more than ever firms need to think about the changing faces of their customers, otherwise they could find themselves behind the curve.

Read more

Exploring the crucial role of payment experience in mid-market insurance, we delve into innovative strategies and technologies that streamline payments, reduce friction, and enhance customer satisfaction.

Read more