Payment Processing for Insurance Companies

Our suite of payment processing solutions designed for insurance businesses allow you to improve payment experiences across the entire policy journey. From collecting premiums, to processing payouts, Access PaySuite will ensure that payments are simplified – making things easier for both your customers, and internal teams.

We provide insurance payment processing to leading insurance businesses

Secure and convenient payment processing for customers

Access Paysuite’s targeted insurance payment solution helps to speed up reconciliation, improve customer loyalty, and reduce payment issues, by allowing you to align with customer payment preferences.

Our payment and direct debit processing software can also help to differentiate your offering, giving you the freedom to process collections and payouts in the way that you want.

Authorised and regulated as a Payment Institution by the Financial Conduct Authority, our full PCI-DSS compliant payment solutions and additional identity verification tools also allow you to ensure safe and secure online payments.

Offer flexibility and choice to your policy holders

Let us help you to facilitate payments for all of your customers; some want to complete transactions in seconds and continue with their day, while others prefer to take their time and speak to an agent to check that their details are correct. Our solutions are people-focused, enabling choice and flexibility to suit everyone.

Download our latest Insurance focused report

Future-proofing payments in the insurance sector

Specifically tailored for insurance companies and brokers of all sizes, this guide delves into the ever-evolving landscape of consumer trends and behaviors within the insurance sector.

Discover invaluable insights and tips to help you navigate current industry challenges, and how to innovate your payment processing strategy to improve customer experience, compliance, and efficiency.

What our insurance payment solutions customer Think Insurance says

Access Paysuite has helped us develop a more reliable and slicker process for our payment collections which has supported our growth, without increasing workload and resource requirements internally to manage. We have plans to enhance the process with them further, taking advantage of the technical solutions available to integrate with our internal system and gain further efficiencies in the coming months.

James Wapples, Think InsuranceBenefits of Access PaySuite payment processing platform for insurance businesses

- Seamless customer experience

-

Give your customers a seamless payment experience by providing a transparent and efficient insurance payments processing service for both collections and payouts.

- Improve payment accuracy

-

Work with us as a payments technology partner that can provide streamlined, integrated payments to improve your operational efficiency.

- Stand apart from your competitors with efficient insurance payment processing

-

Improve your customer experience by using our payment & direct debit processing software. Our integrated solution allows you to create a point of difference through fast, accurate and timely payment collections and claims.

- Improve insurance policy sales by accepting online card payments

-

If you are looking to scale your online insurance policy sales, Access PaySuite’s online card payments processing service can help you facilitate quick and easy checkout for new and existing customers.

Insurance Direct Debit payment solution

Our insurance Direct Debit software is a payment solution designed to make it easier for your customers & team to manage recurring insurance payments. Read the Ripe Insurance case study to find out how our insurance Direct Debit solution helped them streamline their payment processes and ensure data security.

Ripe insurance

Commercially focused on tech and data, Access PaySuite are experts in their field, and our partnership with them is helping to drive our model. In fact, it’s key to keeping our business efficient; plus I know and trust that they’ll stay ahead of changes in banking down the track.

Simple, affordable pricing

No set-up fee and transaction fees as low as 4p. Customised packages available for businesses with large payments volume.

Simplify your operations with our insurance direct debit solution today!

Give your organisation the stability and freedom it needs to drive higher levels of growth by seamlessly automating your payments by using our insurance payment processing solution processes.

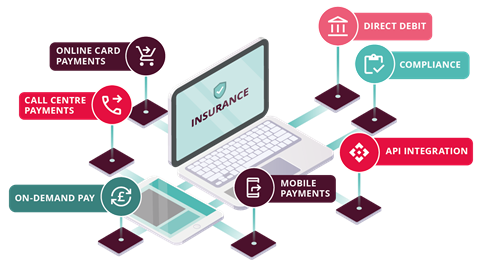

Every payment made easy

Your customers may choose to spread payments out monthly or quarterly, while some might prefer to make one-time payments. Access PaySuite allows you to do either, supporting a range of different payment methods - from online payments or over the phone, and by credit card or directly from their bank account.

As the experts, we’re on hand to help you manage your insurance payments across our range of hassle-free solutions:

Online Card Payments

Get paid online from any device and simplify transactions, giving your customers a simple, seamless online card payment experience.

Online Card PaymentsDirect Debit

Keep track of recurring payments, simplify subscription models, and eliminate the risk of failed collections, using our industry-leading direct debit platform for insurance companies.

Direct Debit PaymentsEmbedded Payments

Connect with your existing internal systems & software using our API integrations, for seamless financial experiences and insights at a glance.

Embedded PaymentsOn-Demand Pay

Engage your workforce and reduce staff turnover by giving employees instant access to their pay with Access EarlyPay.

On-Demand PaymentsDirect Credit

Take full control and make your outgoing payment transfers accurately and efficiently, with one of the most secure and trusted payment methods.

Direct Credit PaymentsReady to start getting paid?

Give your organisation the stability and freedom it needs to drive higher levels of growth by seamlessly automating your payment processes.

Learn more about Insurance Direct Debits & Payment Processing

Five ways payments can help insurers drive value and growth

In this article, we will explore how insurance payment solutions can be the differentiating factor between firms and delve into five key strategies that can help insurers harness the true potential of these solutions to drive value and achieve sustainable growth.

Read more

Customer focus for insurance companies and why you need it

Insurance companies spend a lot of their time thinking about demographics, particularly life insurers, but this is often purely from a risk point of view, but now more than ever firms need to think about the changing faces of their customers, otherwise they could find themselves behind the curve.

Read more

Top 5 tips to sign up customers successfully to Direct Debit

What is the most important reason or benefit for your customers to sign up? The advantages of Direct Debit are numerous. You can choose specific messaging to communicate with your target audience. For example, you may want to convey that Direct Debit is convenient, easy and hassle free.

Read more